dc income tax withholding calculator

This Washington DC bonus pay aggregate calculator uses your last paycheck amount to determine and apply the correct withholding rates to special wage payments such as bonuses. To use our District Of Columbia Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

Publication 505 2022 Tax Withholding And Estimated Tax Internal Revenue Service

Enter annual income from 2nd highest paying job.

. Withholding tax to the District of Columbia. The information you give your employer on Form W4. After a few seconds you will be provided with a full.

If you have a third job enter its annual. Has relatively high income tax rates on a nationwide scale. Overview of District of Columbia Taxes.

Federal and DC Paycheck Withholding Calculator. FICA taxes are made up of two components Social Security Tax and Medicare Tax. Capital has a progressive income tax rate with six tax brackets.

Office of Tax and Revenue District of Columbia INCOME TAX WITHHOLDING Instructions and Tables 2018 FR-230. Determine the dependent allowance by applying the following guideline and subtract this amount from the. Subtract the biweekly Thrift Savings Plan contribution from the gross biweekly wages.

Individual and Fiduciary Income Taxes The taxable income of an individual who is domiciled in the District at any time during the tax year or who maintains an abode in the District for 183 or. Use this calculator to estimate the amount of money that would be withheld from your monthly pension payments for federal income tax based on the IRS current tax tables and. 2013 Income Tax Withholding Instructions and Tables.

Multiply the adjusted gross biweekly wages by 26 to obtain the annual wages. DC Tax Withholding Form. 2015 Income Tax Withholding Instructions and Tables.

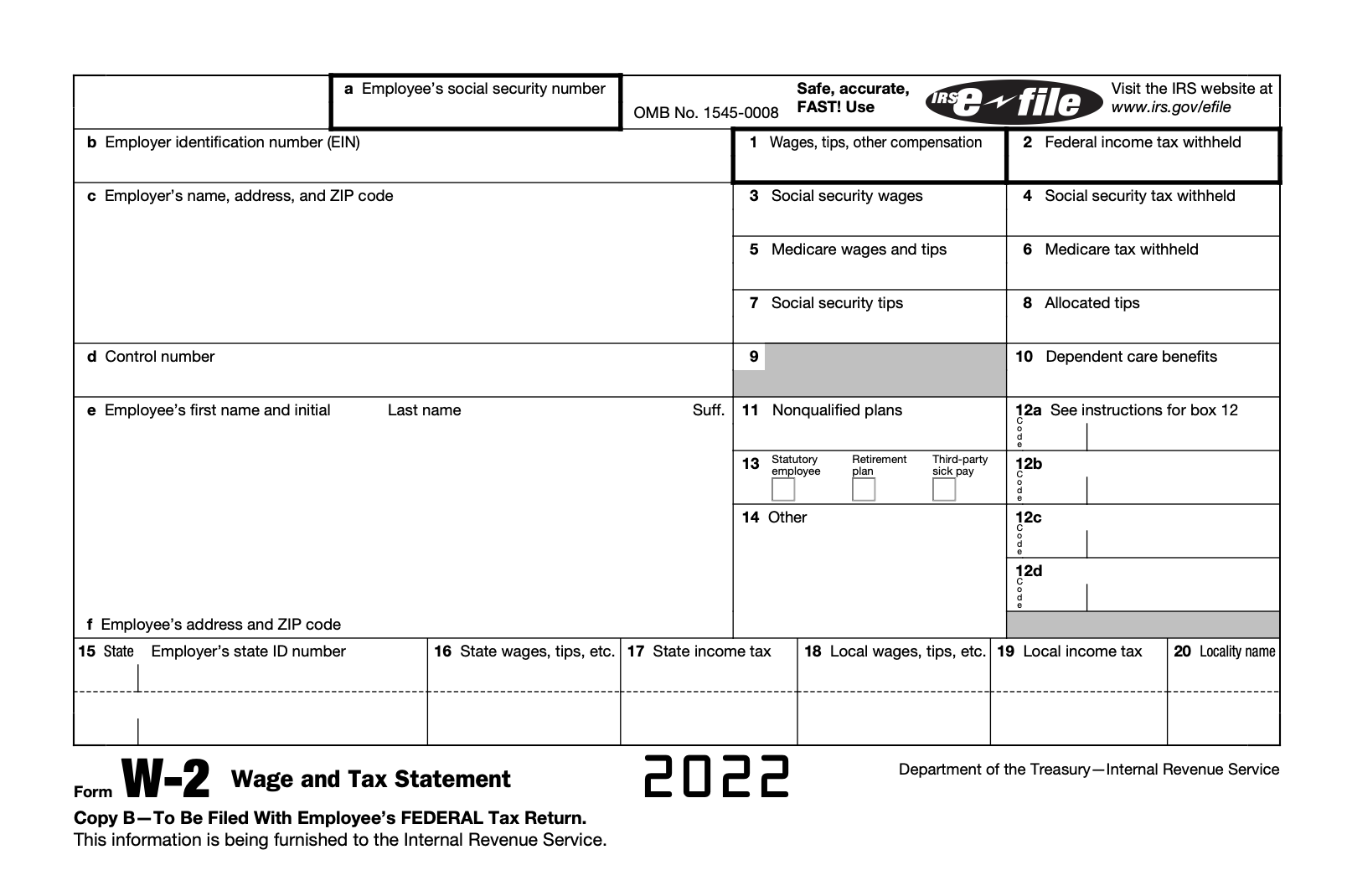

The local income tax rate in Washington DC is progressive and ranges from 4 to 1075 while federal income tax rates range from 10 to 37 depending on your income. When to Check Your Withholding. Form W-4 Tax Withholding Form W-4 Tax Withholding.

Fill Out a Form W-4 - Basic. New job or other paid work. Tax Calculator Lets You Calculate Your State Taxes For the Tax Year.

Follow the link and choose the DC D-4 Employee Withholding Allowance Certificate from the list which you will use to designate your. D-4 Fill-in Employee Withholding Allowance Certificate. For assistance with MyTaxDCgov or account-related questions please contact our e-Services Unit at 202 759-1946 or email e-servicesotrdcgov 815 am to 530 pm Monday.

Subtract the nontaxable biweekly Federal. Withholding Formula District of Columbia Effective 2022. Adjust Form W-4.

2014 Income Tax Withholding Instructions and Tables. Under SB 1828 and effective January 1 2022 the law createsa two-tier individual income tax rate structure of 255 and 298 depending on filing status and taxable income and if general. The Federal or IRS Taxes Are Listed.

Whats New The District of Columbia DC Office of Tax and Revenue OTR will no longer accept CDs or any media for filing W-2s or 1099s. Check your tax withholding every year especially. W-4 Form Basic - Create Sign Share.

Enter annual income from highest paying job. When you have a major life change. You must use the bulk.

Social Security Tax is equal to 62 of your employees taxable wages up to an annual. You can use the Tax Withholding. For help with your withholding you may use the Tax Withholding Estimator.

File with employer when starting new employment or when claimed allowances change.

Washington D C Paycheck Calculator Tax Year 2022

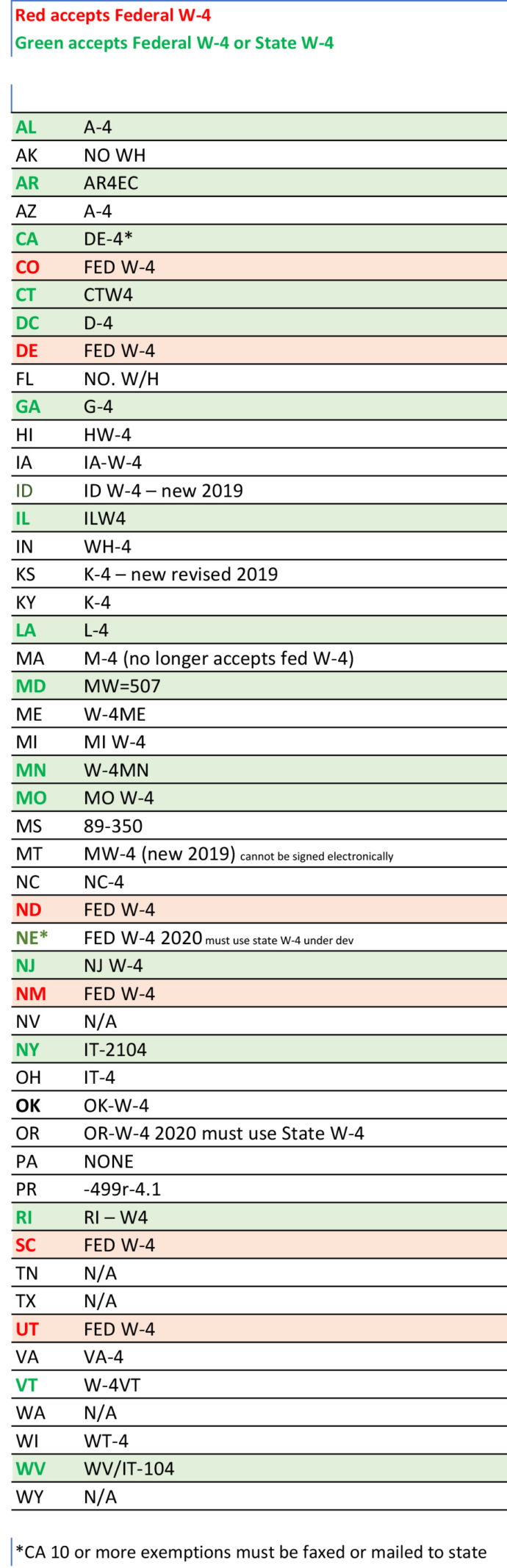

State W 4 Form Detailed Withholding Forms By State Chart

Dc Tax Rates Rankings District Of Columbia Taxes Tax Foundation

Does Virginia Washington Dc Or Maryland Have The Most Favorable Taxes Eli Residential Group

How Do State And Local Individual Income Taxes Work Tax Policy Center

Washington Dc Payroll Tools Tax Rates And Resources Paycheckcity

First Job Here S What You Need To Know About Filing Your Federal Taxes Cnet

2022 Washington Dc Tax Deadlines

![]()

Free Hourly Payroll Calculator Hourly Paycheck Payroll Calculator

Washington Dc Payroll Tools Tax Rates And Resources Paycheckcity

What S My Kicker Oregon Releases Plan For Tax Surplus Money Local Kezi Com

Bonus Tax Rate 2022 How Bonuses Are Taxed And Who Pays Nerdwallet

Updated Withholding Calculator Form W 4 Released Calculator Helps Taxpayers Review Withholding Following New Tax Law News Illinois State

How Do State And Local Corporate Income Taxes Work Tax Policy Center